TAX RATE & REVENUE

Prop SG is a no-tax rate increase bond issue.

Over the last few decades, our dedication to fiscal responsibility has allowed us to keep our tax rate low through no-tax increase ballot initiatives. Often, the statement "no-tax rate increase" can be confusing—essentially, this is a continuation of the present debt service on your tax bill, rather than the district incorporating an increase to the debt service into the bond issue. Prop SG is a no-tax rate increase measure.

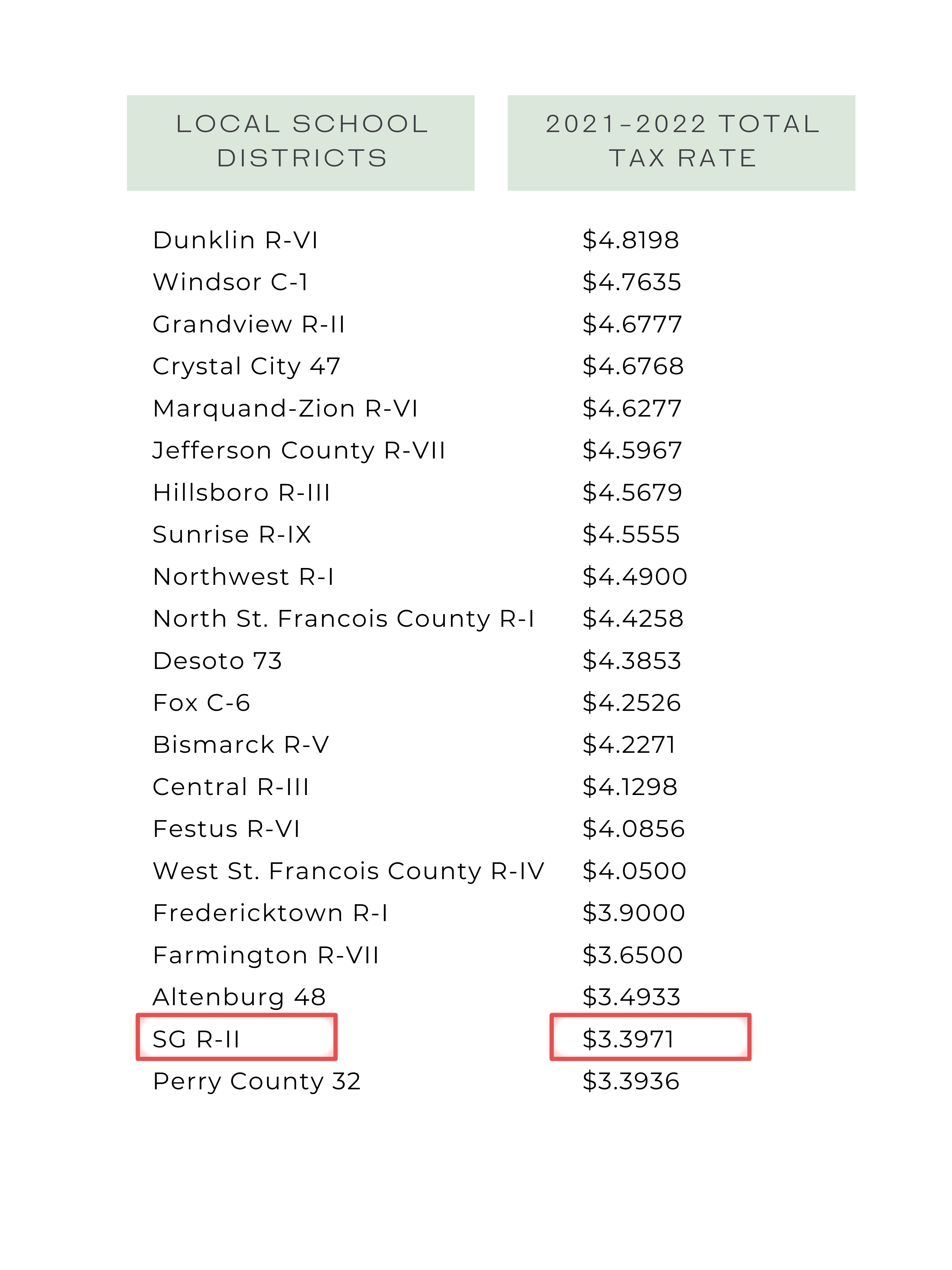

Below is a look at how our 2021-2022 tax rate compared to local school districts. We were happy to be able to decrease our total tax rate by about 6 cents for the 2021-2022 school year!

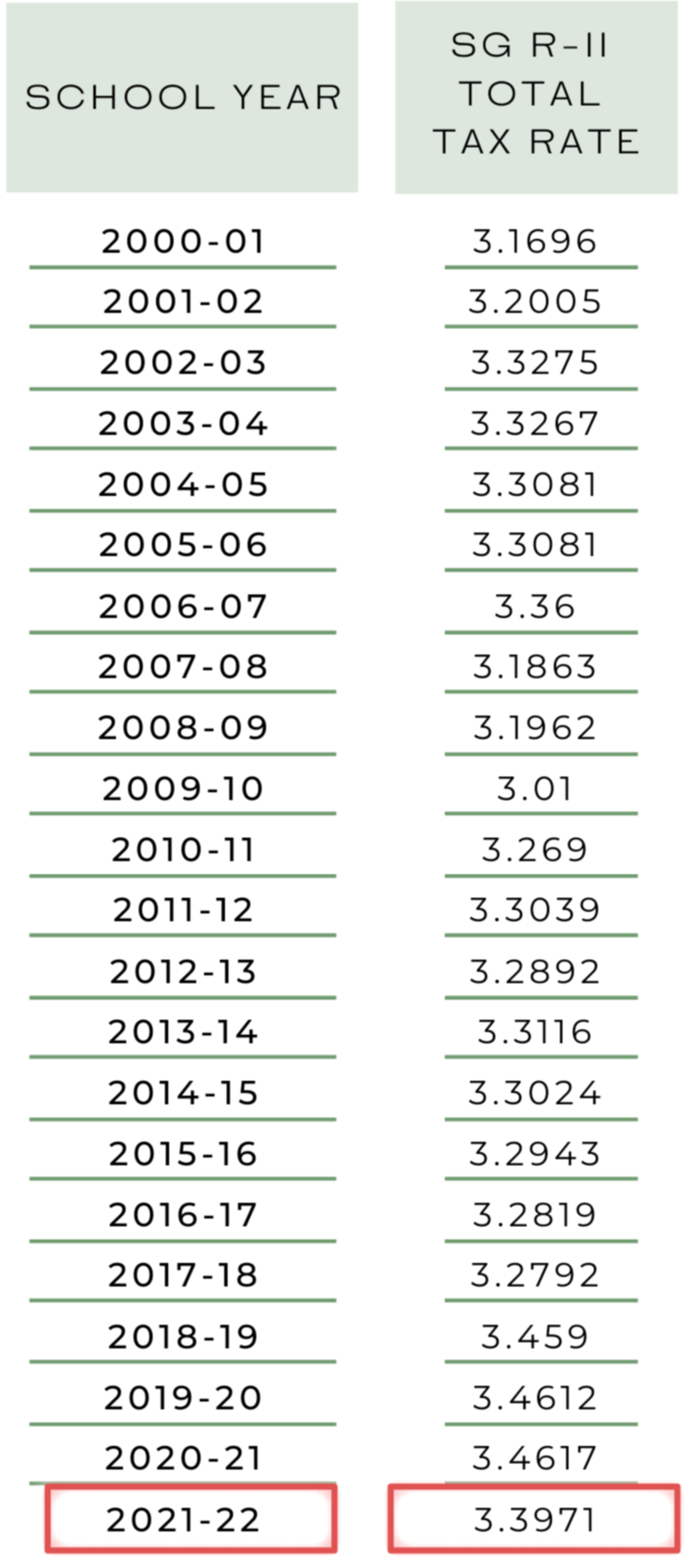

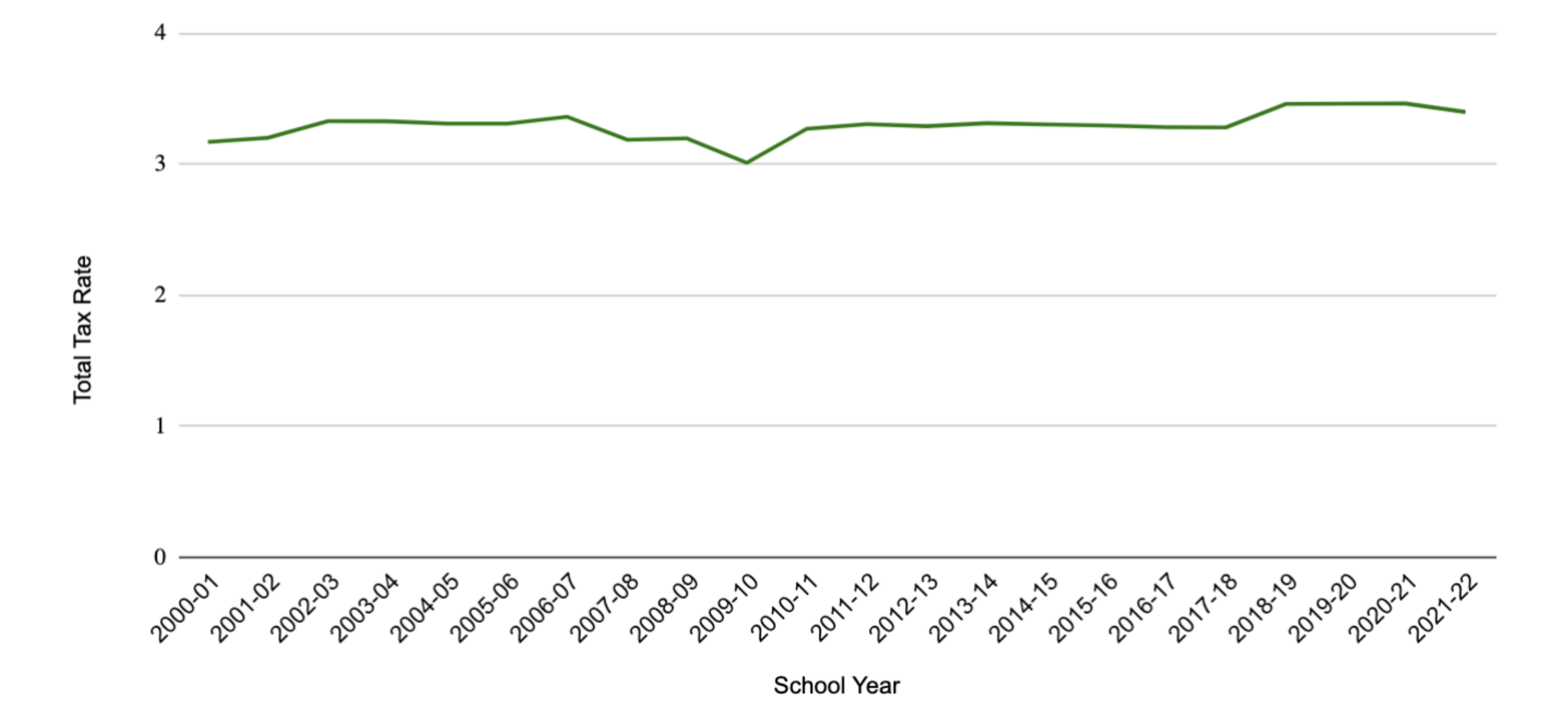

Total Tax Rate by School Year

Learn More About...

~ This webpage will be updated as more information becomes available! ~

***

Paid for by the Ste. Genevieve County R-II School District, Superintendent Dr. Paul Taylor